Real estate trends in Dubai: A complete overview with expert commentary

Dubai’s real estate market maintains a bull run despite inflation. Here is a comprehensive review of Dubai’s real estate sector, including growth reasons, new legislation, and more.

Dubai continues to defy the trend and climb despite inflation, supply chain challenges, and geopolitical conditions, recording remarkable real estate growth figures. According to Asteco’s UAE Real Estate Report Q2 2022, both supply and demand were on the up in the emirate.

Real estate supply overview in Dubai

According to the research, a number of successful and significant project launches occurred in the first half of 2022 as a result of increased confidence in the real estate market. This was first supported by a robust secondary market, While it has resulted in a plethora of new ideas, it has also prompted many Tier-2 developers to reconsider the viability of halted projects. The bulk of projects have been marketed using construction milestone-linked payment arrangements, incentivizing developers to finish projects on time or early, The apartment supply surged from 6,000 units in Q1 2022 to 7,000 units in Q2 2022. The number of finished villas quadrupled, reaching 520 homes. However, throughout the last three months, there were no major new office space handovers.

Asteco has changed its materialization rate in the near term. Another 25,000 residential units are expected to be handed over by the end of the year, with the majority of new deliveries concentrated in upcoming neighborhoods like Damac Hills, Dubai Hills Estate, Wasl Gate, and Port De Mere.

Detailed information about Dubai’s real estate market, including growth factors, recent legislation, and more, is provided below:

The impact of Expo 2020 on real estate

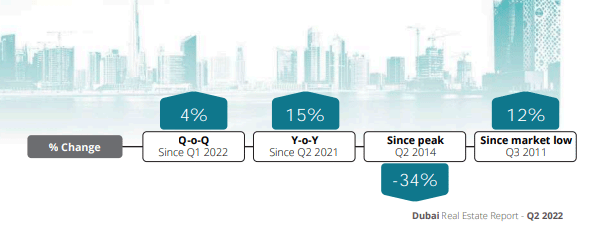

The rental rate increase proceeded with the same vigor as the previous year. The average quarterly increases for flats, villas, and offices were 4%, 6%, and 3%, respectively, with yearly increases of 15%, 23%, and 13%, Demand for bigger unit types, especially villas and townhouses with ample usable outside spaces (such as balconies and gardens) and a robust community offering, remained the primary emphasis of residents, hence driving rental and occupancy rates. In addition to established communities like Palm Jumeirah and Dubai Marina, secondary places with strong community amenities, such as those near the Expo 2020 site, saw an increase in demand for flats in prestigious areas.

Asteco thinks that the beneficial effects of Expo 2020, such as infrastructure enhancements and reuse of the property, will be felt across a broad spectrum of industries for decades. In October 2022, the legacy plan for Expo 2020 Dubai and the Dubai 2040 Urban Master Plan are anticipated to open. It is anticipated that it would become an autonomous free zone as well as an economic and development hub by providing inexpensive housing and serving as a hub for exhibits, tourism, and logistics.

Although geopolitical events and increasing commodity and energy costs cannot be ignored, according to the research, they have aided Dubai’s status as a safe haven. Asteco anticipates that rental rates will continue to rise in the second half of the year, but that rental growth will finally drop as oversupply concerns persist. According to the research, Downtown Dubai and Palm Jumeirah had the biggest rental gain of 24 percent year-over-year, followed by Dubai Beach Residence and Dubai Marina (both 23 percent). Dubai Hills (42%) and Palm Jumeirah (41%), had the most increase in property rental costs, As many offices resumed regular operations, the Business Bay region saw the highest office rental rise of 21%, followed by the DIFC area with an 18% increase.

How the Golden Visa can increase Dubai real estate sales

While many worldwide markets are still recovering from lockdowns and limitations due to COVID, Dubai’s economy has made significant progress. It has rebounded, aided by rising oil prices and a resurgence in tourism and commerce. It has resulted in extraordinary transaction numbers in the first half of the year, notably for off-plan projects and a significant rise in sales of high-end and luxury residential units.

According to the current Henley Global Citizens Report, 4,000 high-net-worth individuals are anticipated to migrate to the United Arab Emirates this year owing to the sophisticated economic, social, legal, and regulatory environment that facilitates business, investment, and residence.

The average quarterly sales prices for apartments, villas, and offices increased by 4, 4, and 2 percent, respectively, and by 20, 26, and 19 percent yearly. Palm Jumeirah (44 percent) and Business Bay (34 percent) had the greatest rise in unit selling prices over the previous year. Palm Jumeirah (52 percent) and Arabian Ranches (40 percent) had the greatest increase in villa sales prices compared to the first half of the previous year.

While demand for off-plan residences surged dramatically, investors and end-users with low means were being pushed out of the secondary market by the rising cost of financing and the shortage of affordable dwellings. On the strength of significant business reforms and government programs such as the Golden Visa and attempts to shift to a digitally-driven economy, strong foreign direct investment is anticipated to continue.

The UAE Cabinet revised the laws for long-term visas in April 2022, indicating that a 10-year Golden Visa may be acquired by acquiring a property for AED 2 million. The property might be finished or unfinished, and it can be financed via local banks. Asteco is likewise of the opinion that the Dubai Land Department’s move to make all real estate data accessible to the public is indicative of a mature market and will increase transparency.

Dubai real estate market resumes bull run in August 2022

The Dubai real estate market registered over AED 1.2 billion on Tuesday, August 2, in accordance with the emirate’s residential property market’s sustained bull run over the last several months.

Tuesday’s transactions comprised 396 sales transactions totaling AED 845.37 million, 110 mortgage transactions totaling AED 376.93 million, and 11 gift transactions totaling AED 96.55 million, according to statistics from Dubai’s Land Department (DLD).

The transactions comprised 356 villas and flats valued at $693.98 million and 40 parcels of land valued at $151.4 million. Included in the mortgage agreements were 94 homes and flats for AED 286.71 million and 16 land parcels totaling AED 90.21 million. Tuesday’s property transaction value, however, was less than the AED 1.8 billion recorded on July 27. On Monday, July 25, the emirate’s market saw real estate transactions of AED 1.2 billion.

In recent weeks, the Dubai real estate market has been on an upward trajectory, with deals over $1 billion on several days and single-day transactions exceeding AED 1.4 billion, AED 1 billion, and AED 3.9 billion on July 22, July 13, and July 7, respectively.

Dubai had a record-breaking AED 22,7 billion in real estate sales transactions in June, the largest sales volume in the last 13 years, and about 71% of the entire sales volume for 2021. Dubai’s property market transactions during the first quarter of 2023 were AED 59.29 billion, up 6.81 percent from Q1 2022.

Dubai real estate report: Commercial rental prices rise by 10 percent

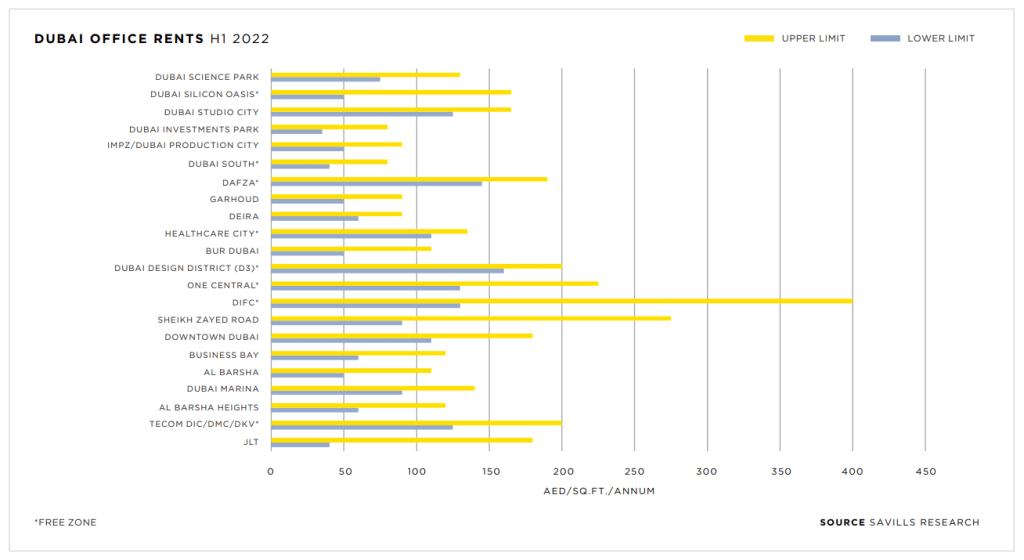

Savills, a real estate market consultant, said that Dubai’s commercial rental prices increased by 10 percent during the first half of 2022, compared to the same time the previous year, due to a surge in demand for office space in Grade A complexes. The annual rise in rents in the emirate was around 13 percent.

According to the study Savills Dubai Office H1 2022: Market in Minutes, rents are increasing in a number of sectors, particularly for ESG-compliant (environmental, social, and governance) spaces, as occupier demand continues to underpin the premium end of the market.

During the first six months of this year, the majority of leasing activity occurred in submarkets such as DIFC, DWTC, DMCC, Dubai Media City, and Dubai Internet City.

In terms of rental performance across office sites, Dubai Investment Park (35 percent) saw the biggest year-over-year growth, followed by Barsha Heights (29 percent), Dubai Production City (27 percent), and Deira (26 percent). Savills said that the contiguous sites of Dubai Internet City—Dubai Media City—and Dubai Knowledge Village, Dubai Healthcare City, and Dubai Design District remained constant.

The survey also identified a rising trend in demand for flexible space choices such as serviced offices and co-working spaces as a result of enterprises seeking to decrease capital outlay expenditures and new market entrants seeking to establish operations in the city.

“The vast majority of renowned operators of flexible space in Dubai are claiming strong occupancy rates, with some even reporting a 100% increase.” They are currently developing plans to significantly increase services in this arena throughout the emirate, according to Savills’ research.

Occupier demand has been robust, according to Savills, as a result of a thriving local economy where enterprises are solidifying their development plans and an inflow of senior executives, company owners, and high-net-worth individuals (HNIs).

According to the research, Dubai’s office occupancy rates were the highest in Europe, the Middle East, and Africa during the second quarter of 2022. According to the most recent Savills Prime Office Costs (SPOC) Report, an average of 80% of employees are back in offices in Dubai in some form.

Paula Walshe, director of international corporate services at Savills Middle East, said that companies are increasingly recognizing the significance of improving their current facilities or relocating to new locations that better meet their changing, pandemic-induced needs.

Walshe said, “Many of our customers find more value in integrating their operations, which allows them to sharpen their focus while realizing considerable cost reductions in the face of escalating operating expenses.”

According to Swapnil Pillai, associate director of research at Savills Middle East, the increasing diversification of the economy and the introduction of new industries, such as virtual assets, contributed to the broadening profile of occupiers.

Dubai real estate prices fell for the first time in 2022 in July, according to a report.

The real estate market in Dubai has had record-breaking transactions in recent months, with month-over-month price increases, According to Home Monitor, property prices dipped 0.31 percent in June, bucking the trend for the first time this year, According to the survey, current property prices in Dubai are AED 1,019 per square foot, and the declining trend “should not be an urgent reason for alarm at this time.”

“The Dubai property market’s resilience in the face of rapidly rising interest rates, inflation that appears to be out of control, and the strength of the dirham as a result of its peg to the U.S. dollar continues to astonish and battle any headwinds and downside risks thrown at it,” said Zhann Jochinke, the chief of a real estate intelligence company.

In June, there were 8,865 transactions, which represents a 38.8 percent rise from the previous year. The rise was driven by residential trades, which accounted for 89.3 percent of all transactions, According to the data, hotel flats accounted for 4,1% of all commercial property transactions, followed by land sales at 2,7% and office transactions at 2,6%.

The average gross rental yield increased to 6.3% in June, the highest level since October of this year. The return on townhouses increased from 5.4% to 5.5%, while the yield on flats increased from 0.7% to 6.82%, As the rate of increase in sale prices slows, the research predicts that rental yields will increase in the following months.

How Property Finder, a Dubai-based real estate portal, uses Golden Visas for talent acquisition

Property Finder, a Dubai-based real estate marketplace, utilizes the UAE’s Golden Visa program to recruit and retain software and data experts, Anuradha Challu, the business’s director of human resources, told Arabian Business that the proptech company is “struggling to recruit product engineers who are eager to pursue a career in real estate.”

“Beyond hiring and maintaining real estate specialists, Property Finder’s recruitment strategy focuses substantially on attracting digital, product, analytics, and engineering expertise,” she stated, As part of their Golden Visa Program, Property Finder will assist software and data engineers, as well as some top executives, in obtaining a 10-year resident visa by paying the associated application and processing expenses.

Challu said that the ultimate objective is “to recruit and retain exceptional engineers and senior personnel.”The UAE has been a magnet for digital talent in recent years, particularly in the e-commerce, platform, and technology sectors. “It has altered its path to be among the possible options where digital talent wants to go, which implies the employment market is becoming candidate-driven and red-hot,” noted Challu of Property Finder.

Explanation of Dubai’s new real estate legislation

In July, Dubai introduced two new real estate laws:

Dubai has adopted a new rule governing the granting of Musataha rights on commercial property in the emirate, Dubai has enacted new legislation to facilitate the expansion of real estate investment funds in the emirate, Law governing the issuance of Musataha rights on commercial property in the emirate –A Musataha agreement offers its holder the right to develop a parcel of land belonging to a party is allowed for a particular time period.

The ordinance was issued by the ruler of Dubai, Sheikh Mohammed bin Rashid Al Maktoum, as part of the emirate’s drive to “consolidate its standing as a preferred global a destination for property investment, according to a WAM release.

According to the new decree, the Musataha agreement provides a real property right entitling its holder to construct or invest in a structure, mortgage, lease, sell, or acquire a parcel of land belonging to a third party for up to 35 years, According to the statement, the agreement may be extended to a maximum of 50 years and can be renewed if a request is made two years before its expiration.

During the term of the agreement, the Musataha holder will be subject to a variety of laws and regulations, including registration with the Dubai Land Department registry or that of the Dubai International Financial Centre. Before altering the commercial land’s use, the holder must also obtain prior clearance from the plot owner, A law in Dubai that encourages the creation of real estate investment funds –

The legislation essentially establishes a registration for property investment funds, whose members will be granted specific advantages to aid them in their investing operations on the real estate market of the emirate, The new regulation was issued by Dubai’s ruler, Sheikh Mohammed bin Rashid Al Maktoum, as part of the emirate’s efforts to become a “global real estate investment destination and attract global property investment money,” according to a WAM statement.

The new record covers government-licensed and -regulated real estate investment funds, as well as those in private and free zones, such as the Dubai International Financial Centre. It includes all real estate in Dubai, Applicants to the registry must have real estate holdings worth at least AED 180 million.

The new legislation also established a commission charged with identifying locations and buildings where funds are permitted to invest. The Dubai Land Department will also designate an appraiser to establish the worth of properties held by the funds.